If there is a professional blogger out there who hasn't made a regrettable, excruciating error in one of their blogs, please tell that person that I hate them. Certainly I have had to correct many published errors. One time I wrote and posted a desperate after-hours baseball highlight blog about Josh Reddick (of all people) and failed to notice that I'd confused his name with Lance Reddick's like half a dozen times. That is probably the 200th most severe factual or mathematical error I have had to correct in my extremely not-illustrious blogging career. Volume blogging, and especially volume blogging without a careful, professional editor, is like sprinting along a balance beam while tired and distracted and out-of-shape. You are going to slip, and sooner or later one of those slips will have extremely embarrassing consequences. And that's not even getting into the times when you get an innocent stranger killed by your unwise mocking of lightning.

Matt Yglesias performs as a big-brained public intellectual, but what he really is is a volume blogger, and a social media provocateur. Yglesias's gimmick is the appearance of rigor and rationality, which he accomplishes mostly by affecting a tone of patronizing superiority. But his real talent is for triangulating positions that will be maximally annoying to what he has identified as a liberal consensus, and then doing just enough Wikipedia-surfing of the issues at hand to launch half-assed arguments and inflame online discourse. These salvos are very popular among people who identify as politically moderate, because the smoke-and-mirrors esotericism guarantees that the ensuing discourse will only grind any productive conversation to a miserable halt. In a very good Washington Post profile of Yglesias, published, rather hilariously, Wednesday morning, his whole fuckin' deal is summed up very beautifully:

The affect is one of solution, of authority, of “aha!”

The effect is vaporous, curious, “huh?”

Dan Zak, Washington Post

You can get rich doing this shit. Dan Zak reports that Yglesias's Substack newsletter, Slow Boring, has at least 13,000 subscribers paying an average of $80 per year "for access to his Yglesiasms." Here you might point out that Defector dot com, a humble creature and astronomy website reliably churning out a high volume of sports blogs, has approximately three times as many active subscribers, without the Washington Post even once reaching out for a profile of Todd Dipshit. It's true, we have a much larger readership than Slow Boring, but it's also true that our subscription revenue is split 24 ways. Relative to the rest of the blogging world, Yglesias is making bank, but for that bank he has to do all the blogging himself. It's a big undertaking—his only editor, Zak reports, is Kate Crawford, who is his wife—and one that necessarily requires that Yglesias ride the razor's edge every day, of churning out content without necessarily always having time to make sure the content is, ah, factually accurate.

Take, by way of an extremely convenient example, the blog that Yglesias published to his newsletter early Wednesday morning. Titled "A new plan to get around the debt ceiling hostage," the blog confronts the somewhat made-up problem that some number of people might be uncomfortable with the so-called Platinum Coin solution to our government's escalating debt, which is itself a made-up problem. The Platinum Coin solution, as my blogger's brain is able to comprehend it, is fun and appealing because it observes that government debt is imaginary: The government quite literally prints money, and so at any given time it could, in theory and in literal terms, just print enough money to cover its debts, in this case by issuing a single coin worth a trillion dollars. As all of the spending that the government has done to accrue the debt was authorized by law, naturally the having of money to pay those debts is not only appropriate but advisable. Simply make one coin worth one trillion dollars, give it to the Federal Reserve (or better yet, Defector dot com), and voila.

Presenting an alternate solution to the Platinum Coin proposition, even in a blog that does a certain amount of throat-clearing about how annoying debt-ceiling zealots have become, means lending credibility to two patently false and ridiculous arguments. First, that a mathematically complex maneuver involving the creation of new securities and calibrated to the appetites of the bond market is a more sober, more appropriate way of handling government debt, which after all is super duper real. And second, that right-wing freaks who use the debt ceiling to hold the federal government hostage are operating in good faith, and can therefore be appeased by offering a sufficiently clever alternative to the simple elegance of Large Coin. I cannot pretend to be an economist, but I can say with absolute certainty that any government spending proposal that does not include the outright surrender of the woke Democrats in the form of brutal, destructive cuts to domestic spending will get precisely nowhere with the people who annually turn the government debt stand-off into a national crisis.

This is why it's a perfect moment for Yglesias: By feinting in the direction of intellectual rigor—his blog pretends to offer a definition of the phrase "bond yields," includes multiple mathematical formulas, and deploys the word "algebra"—our intrepid egghead is able to present an alternative to the Platinum Coin concept, which has gained some amount of steam among people to Yglesias's political left since congresswoman Rashida Tlaib proposed it as a means of funding pandemic recovery spending back in 2020. Yglesias's proposal would have the government issue treasuries—take on new debt, that is—by rejiggering the way that these bonds are currently issued. Instead of borrowing money in $100 increments at the lowest interest rate offered at auction, as is done via the current model, Yglesias would have the government set the interest rate on bonds at some attractive percentage and then sell them to whoever is willing to pay the most in cash for them.

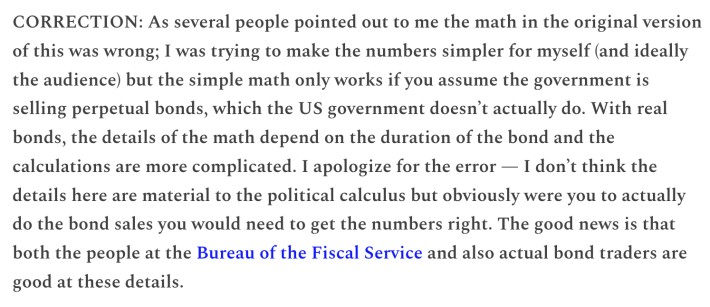

The largest problem with Yglesias's proposal—the thing that makes it fail right on its face—is true math nerd shit. Please hang in here for this part. Treasuries have fixed terms—they are not perpetuities, which generate payments without end—and so there is a relatively fixed maximum value of each one. As explained by God-tier business blogger Matt Levine, the yield to maturity of a U.S. Treasury is not some humongous number that will one day make you rich, and therefore the number you would expect any non-insane person to pay for it at auction is not, like, some eye-popping landscape-altering sum. Yglesias wants the rational market price for one of these hypothetical one-month bonds to be $712 for $100 of debt, but according to Levine it is actually something more like $102 to $105. So this would probably not be a solution to the so-called debt ceiling crisis, unless the government is planning on issuing literally trillions of dollars of treasuries using this dipshit model. Oh well, at least that minor concern doesn't change the political calculus:

Identifying that as a problem in Yglesias's math—let alone a severe, irreconcilable one—takes a level of sophistication that few people possess. This, again, is why it is a perfect proposal for Yglesias—who also lacks the sophistication necessary to make credible policy proposals—to dump into the discourse: He will get credit from stupid people and neoliberals for rigor and outside-the-box thinking, he will piss off smart people who don't have time or bandwidth or a sufficiently large platform to publicly challenge his baloney, and he will stay fixed in the online conversation. For Yglesias, this is the juice. “I find it relaxing to work," he told the Post, of recklessly flinging half-formed, wife-edited bullcrap into an already beshitted public discourse. "I put things out. People yell at me. I will write again the next day.”

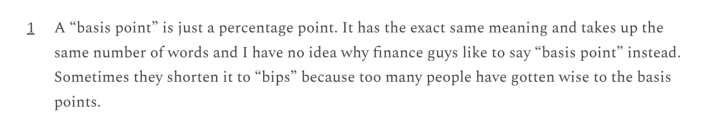

But there's another problem with Yglesias's dipshit blog, and it is the funnier one, by far. At a couple points in the blog Yglesias refers to "basis points," most notably in the section where he sort of haughtily endeavors (and fails) to translate into layman's terms the concept of bond yield. There is nothing in his use of the phrase "basis points" in the body of the blog that requires much of an understanding of the term, which is why it is extra funny that he felt the need to offer the following footnote:

A "basis point" extremely is not a percentage point. In fact a "basis point" is 1/100th of a percentage point. Finance guys like to say "basis point" instead of "percentage point" not only because they are different things, but because math and finance conversations can get very confusing very quickly without a way to differentiate between percentages and, for example, percentages of percentages. As explained to Defector by a highly placed source close to Defector's business operations, "If you told me 'this mortgage will have an interest rate of 10 percent,' and I said, 'what if it were two percent higher,' you would be confused if I meant 'what if it were 12 percent' or 'what if it were 10.2 percent.'" This source went on to point out that if you type the words "why do we use bps instead of percentages" into Google, you do not even need to click on any of the many many many available links to get a perfectly succinct and clear explanation.

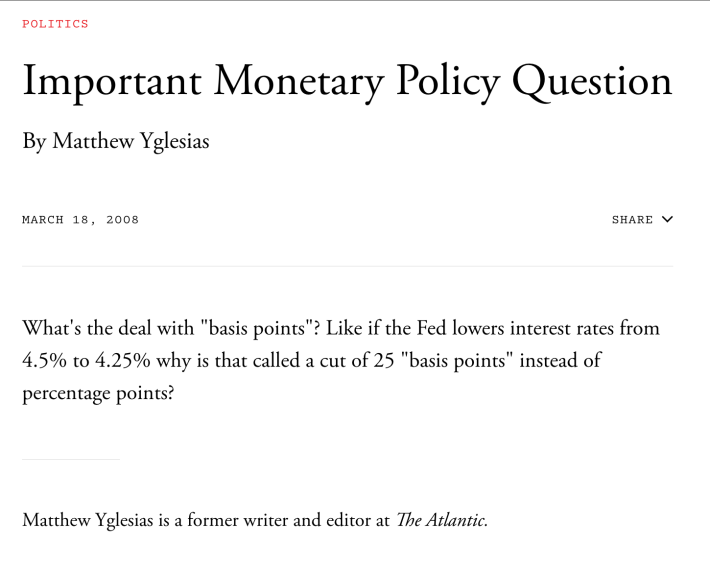

Alas, Yglesias has been struggling with the meaning of per cent for going on 15 years, to no avail:

Matt Yglesias should be able to grasp this, and indeed would grasp this, very easily, if he were as interested in learning things as he is in pretending to already have known them.