There's a decent chance that DraftKings' whole We are going to charge more fees to our gamblers thing was a bluff. Illinois, an important state for the industry, had just wrestled into its budget a hefty increase in the tax rate for online gambling revenues. Among states where online gambling is both legal and popular, those with aggressive tax rates are raking in eye-popping sums. New York, which applies a 51-percent rate on online sports betting, has pulled in over $2 billion in taxes from the industry so far in 2024, per Legal Sports Report, which tracks data from state gaming commissions. New Jersey, with rates between 13 and 15 percent, has pulled in just over a quarter of New York's tax haul, despite having the largest year-to-date handle of any state in the country. Not coincidentally, a New Jersey state legislator introduced a bill in April to double the state's tax rates on casino earnings from online wagering.

If the gaming tax surcharge was a bluff, man, it was a dumb one. Maybe DraftKings CEO Jason Robins was feeling a little bit too powerful, coming off his company's first ever profitable quarter of business. Perhaps he imagined that he and his company would be making a bold stand by appending fees of three to five percent on winning wagers made in high-tax states, and that his competitors would soon imitate his maneuver, and that a united industry would either reap the benefits of a new stream of revenue or would righteously cow these overtaxing state lawmakers back into line. I like to think Robins imagined himself sauntering proudly onto a stage at some queasy tech disruptor event, with some newfangled gizmo conspicuously plugged into one of his ears, boasting to a rapt audience of capitalist freaks about how he either permanently changed the relationship between casinos and gamblers or permanently unshackled the industry from overreaching bureaucrats and regulators, or both. Either way, he was for sure the hero of this story.

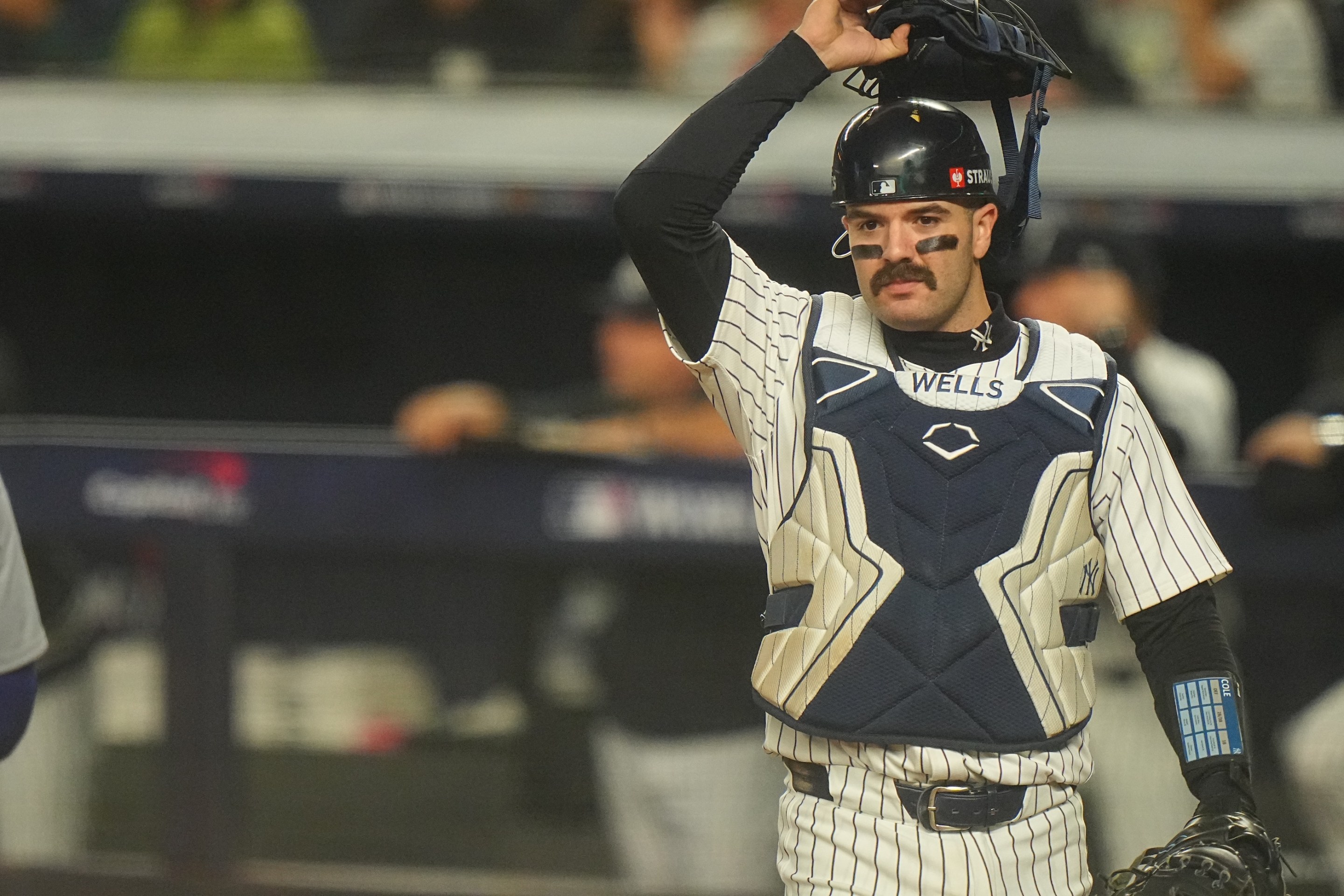

Well, Robins was wrong as hell! FanDuel, the heavyweight in online gambling whose parent company has a market cap approximately double that of DraftKings, announced Tuesday that it too had had a great second quarter, beating analysts' projections in both sales and profits. Also, having been served this opportunity the way that Teoscar Hernández was served meatballs in the Home Run Derby, the CEO of FanDuel's parent company confirmed to Bloomberg Tuesday that FanDuel would not be matching DraftKings' surcharge on winning bets. The opposing maneuvers played out in funny ways: DraftKings reported their profitable quarter and announced the new surcharge last week (plus a buyback program), and their stock immediately lost value; FanDuel reported their profitable quarter and announced that they would not have the surcharge, and their stock price rose by 11 percent in extended trading Tuesday, per Bloomberg, and has risen by another eight percent so far Wednesday.

Not surprisingly, DraftKings followed FanDuel's big Tuesday announcements with one of their own, posting a brief statement online that reverses course on the stupid gaming surcharge.

It's good to see a prime operator in the online gambling industry eat shit, but no one should feel satisfied until the entire industry is actually brought to heel through some meaningful regulations. PASPA may have been a rickety mess, but the legalization of sports gambling has made things appreciably worse, even for non-gamblers. For one thing, the experience of watching sports on television has gotten pretty bad, which I resent. For another, and more importantly, according to two research papers published in the last month and covered in a good Slow Boring blog, online sports gambling has had measurably negative effects on residents of states where it has been legalized, even in the few states that claim eye-popping tax revenues. "Among states with access to online betting," says the Slow Boring blog, "the likelihood of filing for bankruptcy increases by 25-30% after three to four years."

Debt loads go up; collections of unpaid debts go up; credit card delinquencies go up; average credit scores go down. These effects are felt disproportionately by lower-income households: "Households with lower savings balances spend 32% more on gambling as a share of their income than high-savings households," report the authors of the Slow Boring blog, "and households with a history of bank overdrafts spent twice as much as a share of their income as those who did not." Naturally, those effects spread outward from households to neighborhoods and communities. If none of what these reports have to say about legalized online gambling is exactly surprising, it is all still terrible, and is evidence in support of the argument that legal online sports gambling, currently being embraced by state legislatures across the country and pushed onto millions of Americans through ceaseless advertising and ubiquitous brand partnerships, needs some tobacco industry-style regulation, if not a complete vaporization.

My advice to gambling operators is to not add fees to your wagers until such time as your industry returns to the shadows, whereupon you will no longer have to worry about taxes, and can focus on collecting debts by breaking limbs. It was a shitty setup for everyone involved, to be sure, but on the other hand there were far fewer people involved, and the moral compromises were quite a bit simpler.