The shirts for sale at Hometown Deli in Paulsboro, New Jersey, are classic local-deli shirts. They have the deli’s logo and phone number on the front—as if someone’s going to see the t-shirt and place an order—and a cheeky slogan on the back. Eat so we both don’t starve, they read. Pretty funny!

Well. The financial world learned this month that the slogan is, perhaps, not accurate. Hedge fund manager David Einhorn mentioned the deli in a letter to clients a few weeks ago. He noted that, despite being Hometown Deli being a literal deli with one location in “rural” South Jersey, it was also a public company listed on some stock markets under the ticker HWIN. Its valuation made it about a $100 million company.

The financial world loves a bubble, and suddenly we had a bubble of stories about Your Hometown Deli. For my money—say, one share of HWIN—CNBC’s Dan Mangan has done the best reporting on the issue. After a look into the company’s shareholders back on April 15, Mangan later linked the company to a disbarred lawyer who had previously been involved in shell company schemes, as well as to a different shell company. Last week, he reported on the company’s stock being delisted on OTC Markets, an over-the-counter stock market platform. These stories surely contributed to my failure to get a sandwich there the other week, as the deli had been closed after calls from reporters. But whatever Mangan might have done to deny me lunch, even my growling stomach respected the reporter’s hustle. I could only tip my hypothetical cap with “PRESS” tucked in the brim.

Oddly or not, things have not changed much despite all this coverage. Einhorn has still not apologized for incorrectly calling Paulsboro “rural.” (It’s not, really, especially compared to other parts of South Jersey!) The deli’s CEO, who is also principal of Paulsboro High School and a legendary wrestling coach, has continued coaching. And the deli’s stock, despite being delisted, is still right around where it was when Einhorn first wrote about its obviously fishy valuation: A little over 13 bucks. Today it’s down a penny.

That the stock has somehow continued to trade right around where it was before its patent absurdity was exposed to a wide, skeptical audience has enthralled me. I’m not the only one. Matt Levine, author of the popular Money Stuff newsletter, has written two columns about the stock price. The first wondered why anyone would continue to buy the stock after an influential guy like Einhorn warned everyone about it: “Hometown went from a thinly traded pink-sheet deli that nobody had heard of, to a company that everyone had heard of exclusively because it was a poster child for market excess, and … people … bought … it?”

The second column looked at the deli’s financials and, thanks to outstanding warrants shareholders have to purchase stock, declared the deli’s valuation was actually closer to $2 billion. “I do not want to give you investing advice, but I will say that if you went out and spent $100 million to buy all of the stock of Hometown International—which, again, is a deli—you would end up owning only about 5 percent of the company,” Levine wrote.

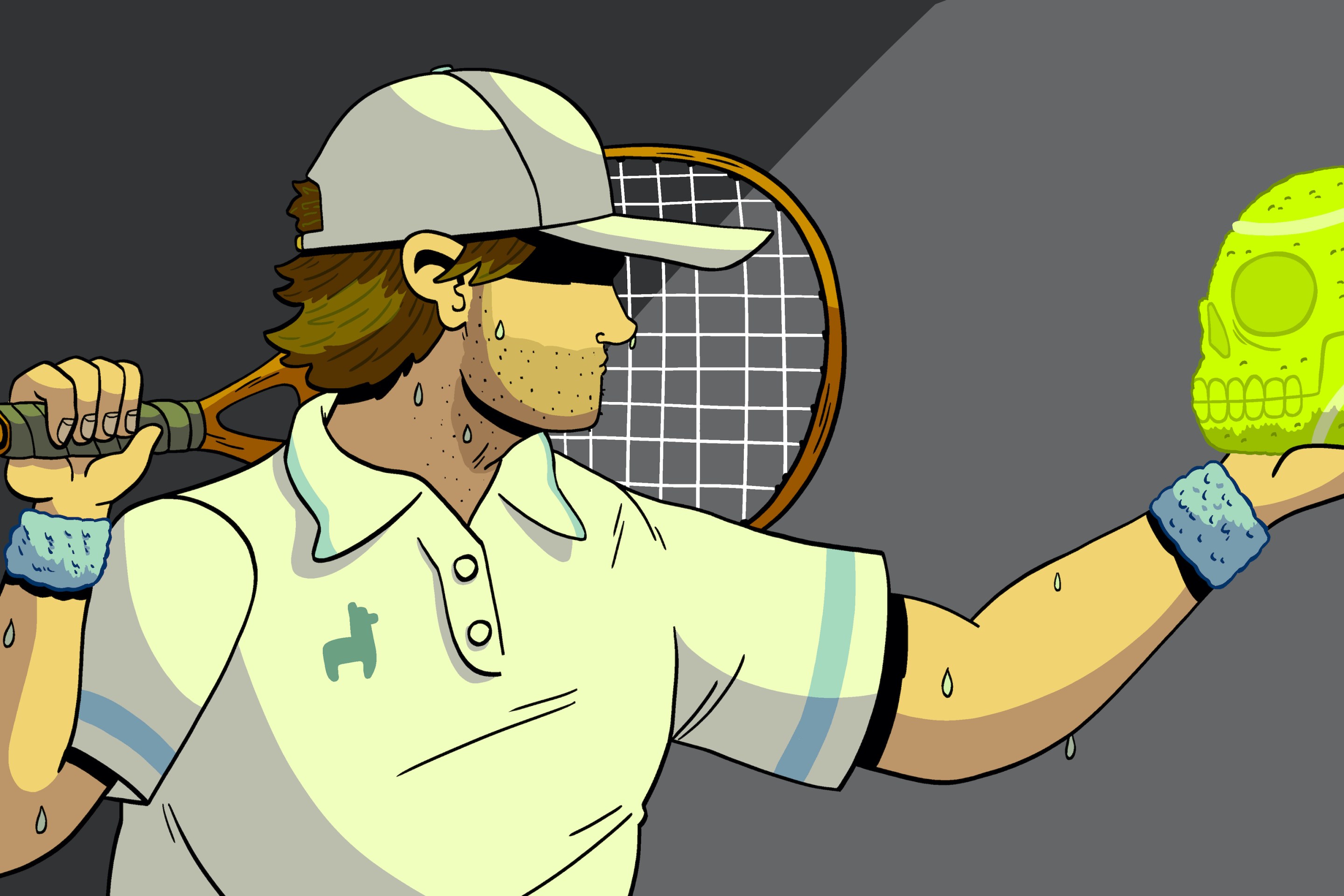

So it’s now a $2 billion deli whose underwhelming revenues are a matter of public record, whose stock continues to trade right around the same price it had when it was just a mysterious stock abbreviation. It was $14.50 at one point in February, was $13.50 in March, and hit an all-time high of $15.75 a week ago. It eventually fell to $13.01 that day. Now it’s $13.23. This isn’t an instance of bored teenagers buying it on Robinhood (the stock is not listed there) or discussing it on WallStreetBets (discussion of a penny stock like HWIN is banned there). Volume has gone down since it was moved to “pink” (the lowest level) on OTC Markets and marked with a skull and crossbones on the company’s buyer beware list. (OTC Markets CEO Cromwell Coulson, who is a real person with a real name, tweeted the company was delisted “for not complying with the rules.”) But the stock is still around 13 bucks and no one can understand how or why. I decided to ask around.

First I went back to John Longo, the Rutgers Business School professor who helped me understand the company’s 10-K. How had this stock not plummeted? “So, you need to have people that want to sell,” Longo says. “And I'm guessing that the insiders of the firm, because of all the scrutiny, are probably reluctant to sell at this time.” You could possibly make money off the stock by selling it short. A user on SeekingAlpha named Gestalt Capital disclosed he was short on HWIN; there are others who are short on the stock. But in order to sell a stock short, you need to find people willing to lend you shares to sell in the first place. There are some shorts available for HWIN. But who wants to do it? You cannot short the stock at large institutional markets.

“As you see, with GameStop, there's a chance that, you know—there’s a trading expression, you can 'get your face ripped off,'” Longo says. “We've seen GameStop just explode upwards exponentially. And that's just highly risky. So even though you can say, in the long run, the stock is way overvalued—in the short run, you kind of might be stepping in front of a steamroller.”

Yan Li, a professor of finance at Temple University’s Fox School of Business, provided me even more info. The stock did plummet upon the release of Einhorn’s letter. It fell to $9.01, and then began a climb back up to its all-time high of $15.75 last Monday. So there was a bit of a sell-off after the news broke. But the stock climbed back up, which to Li suggests there is “not enough selling pressure for this stock.” Short-sales are not widely available. And current shareholders do not want to sell. Since we can’t ask them about what’s going on, I asked Li for some guesses. She had some.

“It is also possible that existing shareholders do not care about this news,” she wrote to Defector in an email. “OTC stocks are typically considered speculative stocks. So those who bought these stocks might be irrational investors. For example, they might overestimate the prospects of this company. Even though the company only has $35,000 sales in the past two years and owns one store now, they might believe that the company would expand into a chain of stores with ‘a new Delicatessen concept’ (as suggested in the company’s annual report). After all, Jeff Bezos started Amazon in a warehouse and some people might believe that HWIN might grow into something big!”

She also said that it was “very likely” investors are trading not on fundamentals but on technical analysis. “Traders often trade based on price actions,” she says. “If there is no selling signal, then they will not sell.” She also informed me of Miller’s hypothesis: When a stock isn’t really available to be shorted, the stock price will be overvalued because those who are pessimistic about the stock can’t express their opinions.

It seems unlikely people invested in the shell company deli—which, to be fair, has not been accused of wrongdoing by the SEC—really think the company is going to become a massive deli franchise with locations paired with wrestling clubs all around the country. But maybe the food was that good? I decided to drive down again last week to one, see if it were open and, two, see if I could get a pizza steak there.

I was not the only one to show up last week. The deli is a large space, lightly decorated, with several card tables covered in plastic tablecloths. Both NJ.com food reviewer Peter Genovese and my old colleague at Philadelphia magazine Victor Fiorillo also did food reviews last week. And a crew from CBS News was stationed outside while I ate there last Tuesday, which is how my car made it onto CBS This Morning on Saturday.

Also there on Tuesday: a bunch of local gawkers! Like me, they’d heard about the deli on the news and wanted to see how good the food was. Like me, they also purchased t-shirts from Hometown Deli. Including mine, the deli sold six t-shirts just while I was there eating. Maybe the future of this business is not in cold cuts but t-shirts?

In the Philadelphia area there are a lot of stupid “rules” for how you’re “supposed” to eat a cheesesteak. They are silly; you should eat a cheesesteak however you’d like. My typical order is American, witout onions and (if they have it) pizza sauce. Lots of places do pizza steaks differently, which is why I thought it would make for a nice test of Hometown Deli. Another factor in my thinking was that I wanted a pizza steak.

My pizza steak was served to me alongside a mountain of French fries. The sauce was mixed in with the steak, which is different than most places that simply plop it on top of the mountain of meat. And it was very good! Mixing in the sauce with the steak sometimes creates a gloopy mess, but at Hometown Deli my steak was scrumptious throughout. (This is why I’m not a food writer.) Genovese complained about a soggy roll, but mine stayed firm throughout. It was a great sandwich!

As for my informed opinion: Was the pizza steak worth $2 billion? Yes, sure, why not.